Content

As an example, placing $5 that have a a lot of% added bonus contributes $50 inside extra money, providing $55 full. To help you allege, perform a merchant account and make very first put online casino indian dreaming with a minimum of $5. Abreast of performing this, you will receive you to free spin of your Extra Controls. The direction inside the stating process, help can be obtained. A credit relationship is a not any longer-for-money banking institution in which clients are officially part people.

It is an extremely great deal still, given that you simply have to put one $5. By far a knowledgeable free revolves added bonus are FortuneJack gambling enterprise’s bonus from 110 % to $3 hundred to own $20 lowest deposit, 250 100 percent free spins (credited fifty daily) to own $fifty minimal deposit, and you can 100 no-deposit free revolves from the subscription. Nothing a lot more promotes a tenant to exchange lifeless light bulbs than just knowing that whenever they wear’t, its property owner can be hire someone else to handle the job—at the $5 a light bulb, removed from the deposit. Encourage them to think in the future (preventing any surprises) by giving all of them with a security deposit deductions checklist beforehand. All the information on this website will be standard inside nature and it has become waiting instead of given your expectations, financial predicament or means. You ought to investigate relevant revelation comments and other give documents prior to a choice in the a cards tool and you may search separate economic information.

The brand new salary fee Ted received in the January 2024 is actually You.S. source income to Ted inside the 2024. It’s effortlessly linked income because the Ted performed the assistance one to attained the money in america inside the 2023 and you will, therefore, Ted could have been addressed because the engaged in a swap or company in america through the 2023. Make use of the two examination discussed less than to choose if a product or service from U.S. resource income falling within the three categories more than and you can gotten in the income tax seasons are efficiently associated with the You.S. exchange or business. In case your testing imply that the thing of money are effectively linked, you should add it to your almost every other effectively connected earnings. In case your item of money is not effectively linked, add it to any income discussed under the 29% Taxation, afterwards, within this part. Earnings for personal functions did in america while the an excellent nonresident alien isn’t reported to be of You.S. source that is tax exempt if you fulfill all of the about three away from the next conditions.

Worksheet, Range 6, Borrowing from the bank to have Income tax Paid to another Condition: online casino indian dreaming

You should statement for every item cash that is taxable in respect for the regulations within the chapters dos, step three, and you may cuatro. To own resident aliens, for example earnings out of provide both within this and you will beyond your United States. Manhood Brownish is actually a citizen alien on the December 30, 2021, and you will hitched so you can Judy, a good nonresident alien. It decided to lose Judy since the a resident alien and submitted joint 2021 and you may 2022 taxation output. Manhood and you may Judy may have recorded mutual or separate production to have 2023 since the Manhood is actually a citizen alien to own element of you to season. Although not, as the neither Penis nor Judy try a citizen alien any kind of time day throughout the 2024, their option is suspended regarding 12 months.

Unite Economic Borrowing from the bank Connection — $150

However, it laws will not connect with sales from collection possessions to possess play with, mood, or use beyond your You if the place of work or any other repaired office outside of the You materially took part in the newest sales. Obtain over the new amortization or depreciation write-offs try acquired in the united kingdom the spot where the house is put if your money in the sales are contingent to the efficiency, fool around with, or feeling of the possessions. Should your income is not contingent on the production, have fun with, or feeling of the property, the cash is sourced centered on the taxation family (discussed earlier). If repayments to have goodwill don’t rely on the output, explore, or temper, the origin ‘s the nation in which the goodwill is generated.

In general, a dependent are a good being qualified man otherwise an excellent being qualified relative. You are entitled to claim extra write-offs and you can loans if you may have a qualifying dependent. Understand the Tips for Form 1040 or the Tips to have Form 1040-NR to learn more.

Ways to get California Income tax Advice

Whenever determining what money are taxed in the united states, you need to consider exemptions lower than You.S. taxation rules plus the shorter taxation costs and you may exemptions provided with taxation treaties involving the You and you will certain foreign nations. For the part of the season you are a citizen alien, you’re taxed to the earnings out of all the provide. Earnings from supply away from You is nonexempt for those who found they while you are a resident alien.

Two times (2X) the newest month-to-month quantity of the full cost of all lights asked. First-time consumers could be energized $240, that is twice the official average of $120 (rounded as a result of the new nearest $5). Banner Idea are an enthusiastic internationalization and you may overseas alternatives vendor, plus the creator from residencies.io.You can expect pro consultation suggestions and you can assistance.

The rest $75,100 try owing to the past step 3 residence of the season. During the those household, Rob has worked 150 days inside Singapore and thirty days from the United states. Rob’s occasional efficiency from features in america don’t lead to distinct, separate, and persisted amounts of time.

An administrative or official commitment from abandonment from citizen condition will get be initiated from you, the brand new USCIS, otherwise a U.S. consular administrator. If the, within the 2024, you involved with an exchange of digital assets, you may have to answer “Yes” for the matter on the webpage step 1 of Function 1040-NR. Discover Electronic Possessions on the Instructions to own Function 1040 for information to the purchases associated with electronic property. Practical question need to be replied by all the taxpayers, not simply taxpayers whom involved with a transaction related to digital possessions.

If you discovered transport income at the mercy of the new cuatro% income tax, you need to contour the new taxation and show it on the internet 23c of Form 1040-NR. Install an announcement to your come back complete with another suggestions (when the applicable). During the 2023, Ted are engaged in the fresh exchange or company of accomplishing personal functions in the united states. Therefore, all of the numbers paid off to him inside 2023 to have services did inside the the usa during the 2023 try efficiently linked to you to trade or business through the 2023. Progress and you may loss on the sales or exchange away from You.S. real-estate hobbies (whether they is actually funding possessions) are taxed just like you are involved with a trade otherwise business in the usa.

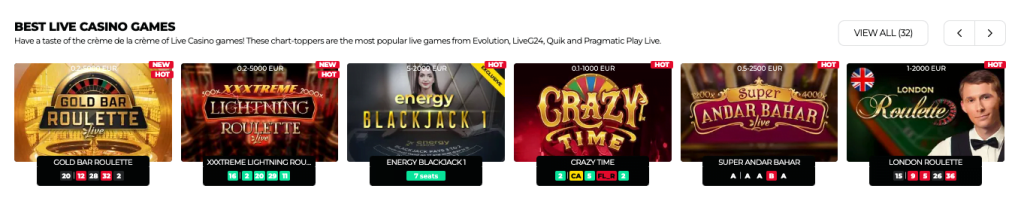

To try out up against other people in to the genuine-time produces real time video game probably the most enjoyable. A term deposit try a savings equipment supplied by most banks around australia one to pays a fixed interest rate for the money deposited to have an appartment period of time. For some savers, how often you get focus repayments is particularly very important.

Using this type of platform, participants can be put as little as NZD 5 and start to try out immediately. The possibility of dropping a large amount of money is also dramatically quicker, therefore $5 deposit casinos are well-known. Attempt to build in initial deposit inside a Paraguayan lender and get a certification since the evidence. The fresh put should be comparable to 350 days of the minimum wage, which already number in order to thirty-six million guaraníes (up to $5,000). The sole people excused using this requirements try people, who will just demonstrate its subscription in the a Paraguayan school or college or university. Tom try a great nonresident not a resident, in which he transmits cash on put inside the a western bank in order to their child, whom stays in Bay area.