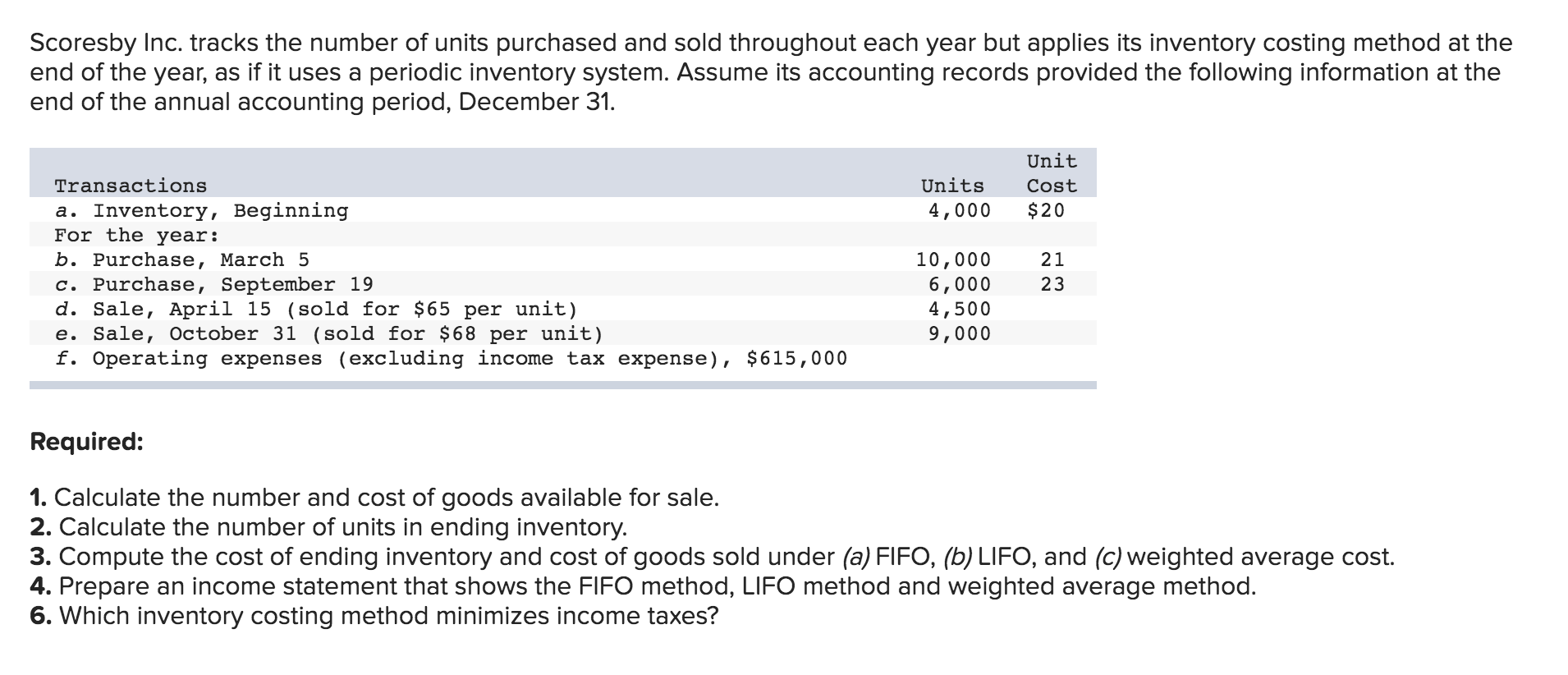

For example, fresh meats and dairy products must flow in a FIFO manner to avoid spoilage losses. In contrast, firms use coal stacked in a pile in a LIFO manner because the newest units purchased are unloaded on top of the pile and sold first. Gasoline held in a tank is a good example of an inventory that has an average physical flow.

LIFO (Last-In, First-Out)

Companies have their choice between several different accounting inventory methods, though there are restrictions regarding IFRS. A company’s taxable income, net income, and balance sheet balances will all vary based on the inventory method selected. If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. Inflation is a measure of the rate of price increases in an economy. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf. However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period.

Example of LIFO vs. FIFO

Businesses that use FIFO record the oldest inventory items to be sold first. When inventory is sold, the oldest cost of an item in inventory will be recovered and then reported on the income statement as part of the cost of goods sold. We track how many items were bought at the oldest price tier and then use them all up before moving onto the next price tier. It’s simple – you divide the total cost of purchased items by the number of items in stock. The FIFO and specific identification methods result in a more precise matching of historical cost with revenue. However, FIFO can give rise to paper profits, while specific identification can give rise to income manipulation.

Is FIFO a Better Inventory Method Than LIFO?

- With a Perpetual Inventory System, inventory and cost of goods sold accounts are updated with each sale, or perpetually.

- Knowing how to manage inventory is a critical tool for companies, small or large; as well as a major success factor for any business that holds inventory.

- In contrast, firms use coal stacked in a pile in a LIFO manner because the newest units purchased are unloaded on top of the pile and sold first.

- Managing inventory can help a company control and forecast its earnings.

- Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently.

It allows them to record lower taxable income at times when higher prices are putting stress on their operations. Assuming that prices are rising, this means that inventory levels are going to be highest as the most recent goods (often the most expensive) are being kept in inventory. This also means that the earliest goods (often the least expensive) are reported under the cost of goods sold.

Companies with perishable goods or items heavily subject to obsolescence are more likely to use LIFO. Logistically, that grocery store is more likely to try to sell slightly older bananas as opposed to the most recently delivered. Should the company sell the most recent perishable good it receives, the oldest inventory items will likely go bad. In the tables below, we use the inventory of a fictitious beverage producer called ABC Bottling Company to see how the valuation methods can affect the outcome of a company’s financial analysis.

Inventory Costing Methods Explained Best Practices for eCommerce

LIFO supporters contend that it makes more sense to match current costs against current revenues than to worry about matching costs for the physical flow of goods. Supporters of FIFO argue that LIFO (1) matches the cost of goods not sold against revenues, (2) grossly understates inventory, and (3) permits income manipulation. In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age. No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS). Both the LIFO and FIFO methods are permitted under Generally Accepted Accounting Principles (GAAP).

Here is a high-level summary of the pros and cons of each inventory method. All pros and cons listed below assume the company is operating in an inflationary period of rising prices. When sales are recorded using the FIFO method, the oldest inventory–that was acquired first–is used up first. FIFO leaves the newer, more expensive inventory in a rising-price environment, on the balance sheet. As a result, FIFO can increase net income because inventory that might be several years old–which was acquired for a lower cost–is used to value COGS. However, the higher net income means the company would have a higher tax liability.

In the video, we saw how the cost of goods sold, inventory cost, and gross margin for each of the four basic costing methods using perpetual and periodic inventory procedures was different. The differences for the four methods occur because the company paid different prices for goods purchased. Since a company’s purchase prices are seldom constant, inventory costing method affects cost of goods sold, the inventory costing method that results in the lowest taxable income in a period of rising costs is: inventory cost, gross margin, and net income. Therefore, companies must disclose on their financial statements which inventory costing methods were used. The four inventory costing methods, specific identification, FIFO, LIFO, and weighted-average, involve assumptions about how costs flow through a business. In some instances, assumed cost flows may correspond with the actual physical flow of goods.