It is up to the company to decide, though there are parameters based on the accounting method the company uses. In addition, companies often try to match the physical movement of inventory to the inventory method they use. The accounting method that a company uses to the inventory costing method that results in the lowest taxable income in a period of rising costs is: determine its inventory costs can have a direct impact on its key financial statements (financials)—balance sheet, income statement, and statement of cash flows. Changes should be made at the end of an accounting period and cannot be changed each accounting period.

For More Mature Businesses

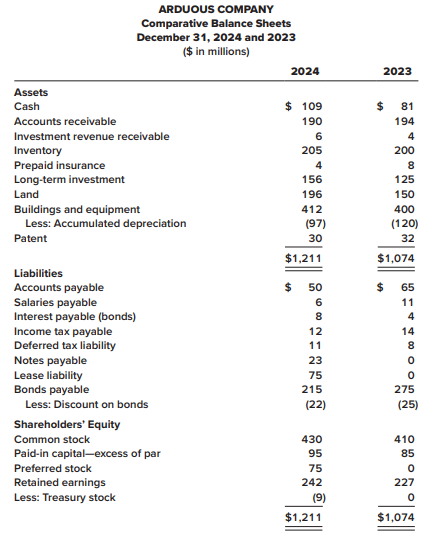

As a result, inventory is a critical component of the balance sheet. Therefore, it is important that serious investors understand how to assess the inventory line item when comparing companies across industries or in their own portfolios. As you can see the value of a company’s inventory does directly impact their reported income and general financial health.

Inventory Costing Methods Explained Best Practices for eCommerce

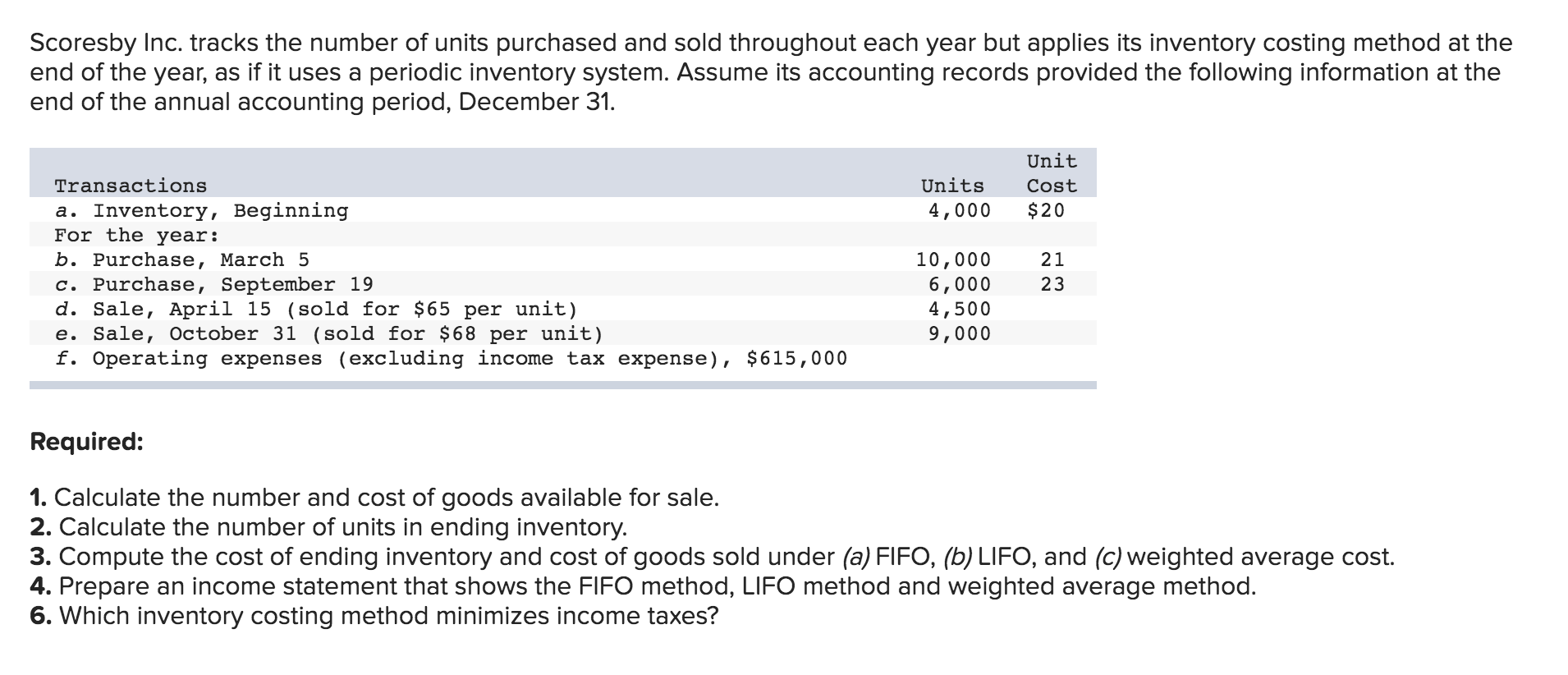

If we switch inventory methods, we must restate all years presented on financial statements using the same inventory method. Inventory is not as badly understated as under LIFO, but it is not as up-to-date as under FIFO. A company can manipulate income under the weighted-average costing method by buying or failing to buy goods near year-end. However, the averaging process reduces the effects of buying or not buying.

How to Optimize Your Inventory Accounting for Your Ecommerce Store

Under LIFO, these higher costs are charged to cost of goods sold in the current period, resulting in a substantial decline in reported net income. To obtain higher income, management could delay making the normal amount of purchases until the next period and thus include some of the older, lower costs in cost of goods sold. Under the LIFO method, assuming a period of rising prices, the most expensive items are sold.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

- $15, because they were the last items bought, so they are the first items sold.

- For these items, use of any other method would seem illogical.

- The differences for the four methods occur because the company paid different prices for goods purchased.

- Therefore, it is important that serious investors understand how to assess the inventory line item when comparing companies across industries or in their own portfolios.

The larger the cost of goods sold, the smaller the net income. Most companies use the first in, first out (FIFO) method of accounting to record their sales. The last in, first out (LIFO) method is suited to particular businesses in particular times. That is, it is used primarily by businesses that must maintain large and costly inventories, and it is useful only when inflation is rapidly pushing up their costs.

FIFO has advantages and disadvantages compared to other inventory methods. FIFO often results in higher net income and higher inventory balances on the balance sheet. However, this results in higher tax liabilities and potentially higher future write-offs if that inventory becomes obsolete. In general, for companies trying to better match their sales with the actual movement of product, FIFO might be a better way to depict the movement of inventory. One disadvantage of the specific identification method is that it permits the manipulation of income.

The method allows them to take advantage of lower taxable income and higher cash flow when their expenses are rising. Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex. Knowing how to manage inventory is a critical tool for companies, small or large; as well as a major success factor for any business that holds inventory. Managing inventory can help a company control and forecast its earnings. Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently.

Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company’s process of using the oldest inventory first in selling their goods. LedgerGurus has a team that specializes in the management of inventory. With our help, you are sure to see an improvement in the profitability and general financial health of your business. It may be wise to do adjustments periodically (every couple years or so) to all average costs to bring them closer to an average that more accurately reflects recent costs. The first criticism—that LIFO matches the cost of goods not sold against revenues—is an extension of the debate over whether the assumed flow of costs should agree with the physical flow of goods.

$12, because the first 75 shirts we bought cost $12, so they are the first ones considered sold. All four methods of inventory costing are acceptable; no single method is the only correct method. In periods of deflation, LIFO creates lower costs and increases net income, which also increases taxable income.